How to Teach Good Money Habits to Kids

Being a parent isn’t always easy… especially when it comes to teaching kids good money habits. With this in mind, we all probably remember our first meeting with money management coming in the form of a piggy bank. You’d usually be given a buck from the “tooth fairy” or even a few nickels from family after doing some chores. We would be given money but never taught how to effectively save and not instantly spend every cent we received.

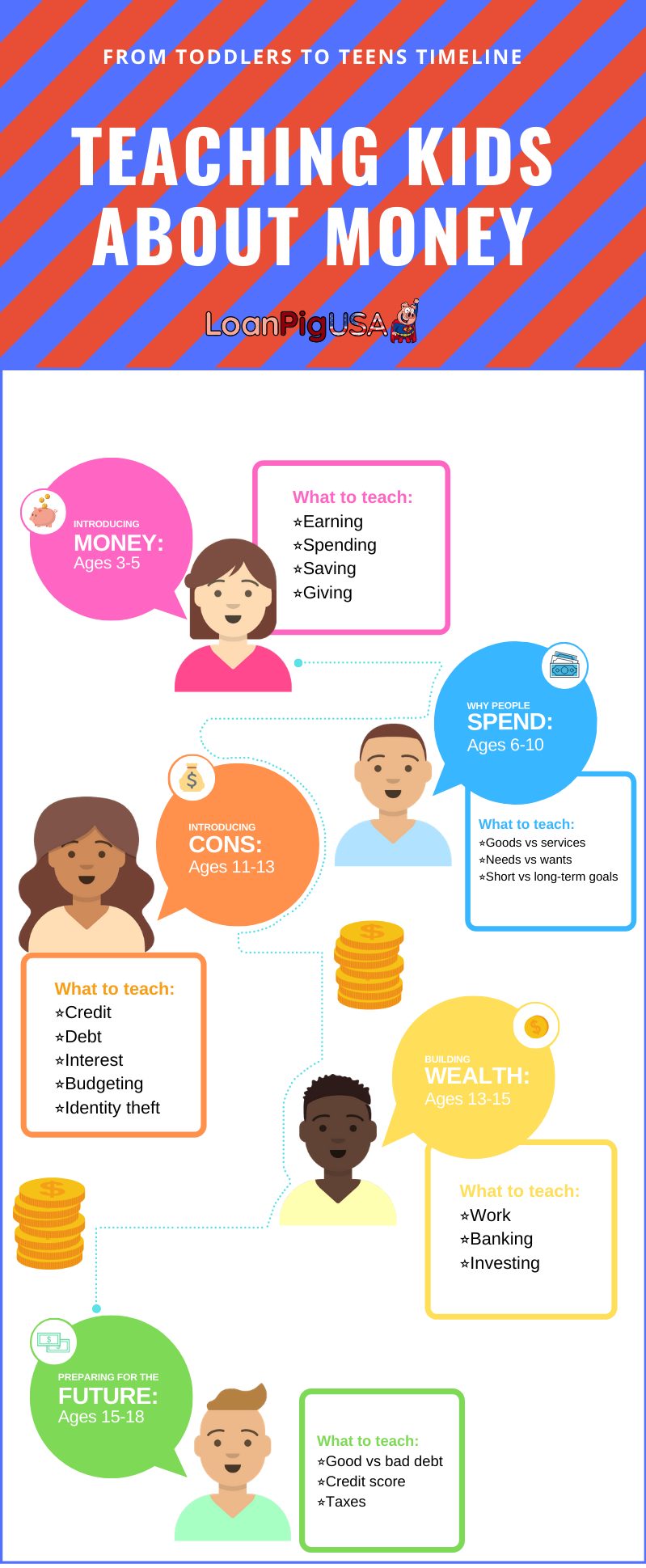

However, teaching financial responsibility shouldn’t just stop with giving your child a piggy bank. Teaching good money habits to kids from ages as early as three can help them from making mistakes in the future.

Here are some important money lessons that we should all be teaching our kids to help them keep their finances in check.

1. Demonstrate good financial behavior

Children have a tendency to copy what their parents or elders do. As kids are very observant, parents should lead by example and demonstrate good financial behaviour. This could include things like shopping on a set budget, or using coupons and discount offers to pay less for goods, which can all make a huge impact on savings. Be sure to talk about money management and let your kids observe ways in which they can utilize their funds.

2. Start saving for the future

Having savings is a very common concept in almost all households. It is a good financial foundation to show your kids as it teaches them that some things are worth the wait. Even though, it can be difficult to implement as kids quickly become attracted to the latest items on the market.

A good tip is to open a savings account for your child to which they contribute each week. At the end of each month, show them the monthly bank statement — this will motivate them to save more from their weekly pocket money.

3. Involve them in budgeting

Your kids can learn constructive money habits by having an involvement in the weekly shopping planning or creating monthly budgets. When visiting the grocery store and other shops, let your children take control of the shopping lists. Encourage them to choose the best products with value and the situation to discuss spending, saving, planning and more. As budgeting should be a part of yours and your kid’s lives, training kids to budget is essential.

4. Teach kids patience when buying

This task can be the hardest lesson for every age group to learn, heck… we are still learning this to this day. However, it can be especially difficult for teenage children. As parents, you should assist them in choosing things that they will really need. Not just something they want due to the latest trend…

The phrase “money doesn’t grow on trees” is a guide that every parent should use to raise financially responsible children. From an early age, kids need to learn that if they really want to buy something, they have to wait and save up to buy it. Engraving this into your children’s heads will enable them to get into the routine of saving in advance. Also, make sure to ensure that they understand that going to the store doesn’t always mean you will or have to buy something.

5. Making mistakes

We know that it is hard not to tell your kids what to do to benefit them financially, but you’ve got to let them make their own mistakes to learn from their own actions. That is even if you believe that your child is about to waste their money on a piece of clothing, toy or game they will be soon tired of. Letting them buy the item(s) might just teach them a lasting lesson. They will feel like they wasted money on toys they enjoyed only once or twice and will remember this for future reference. Well, we hope that they will remember. So, let the kids do the work themselves, let them make mistakes and have fun. Explain how you learned from certain missteps in your own childhood.

Thoughts?

Teaching your children about money at any stage in their life isn’t always going to be easy. But if you want your children to successfully manage their money when they get older, taking the time now will be worth it.