PAYDAY LOANS AND LENDERS, HEROES OR VILLAINS?

Introduction

Some consider Payday loans and lenders as controversial in the industry of consumer finance. The size of the payday loan is usually small and repayable in one installment, which is usually on the next payday of the borrower.

A Payday loan can range from $100 to $2500 US dollars. The maturity of the loan is generally fourteen to thirty days. Fees are dependent on state but can be $15 to $20 on every $100 loan. Annual payday loan percentage is reported from 390% to 700% percent (Banks et al. 2015), depending on which state you are in.

According to reports, 20% of residents of US are financially constrained. Payday lenders are used by 15% of US residents. This payday lending has grown 40% based on annual data. Federal and state authorities have take the initiative to cut down payday loan and lender practices, though the demand of payday loan is increasing on a significant rate and Payday lending is restricted in a small number of states

Positive aspects

An advantage associated with a payday loan can be described as; the shortfall of a person can be resolved immediately without creating a financial burden. This lending process generates a smooth flow of financial resources.

There are a number of ways to be charged with an unforeseen bill, like bouncing a check, late payment fee addition with the capital amount, suspended services and many more problems associated with other borrowings, all of which could be avoided by using a payday loan service.

According to a few expert opinions, these lending practices can be used for financial welfare generation (Banks et al. 2015). Analysis of zip code of California is taken into consideration between 1996 to 2002. The findings showed that payday loans are effectively helpful in people with a great financial shortage.

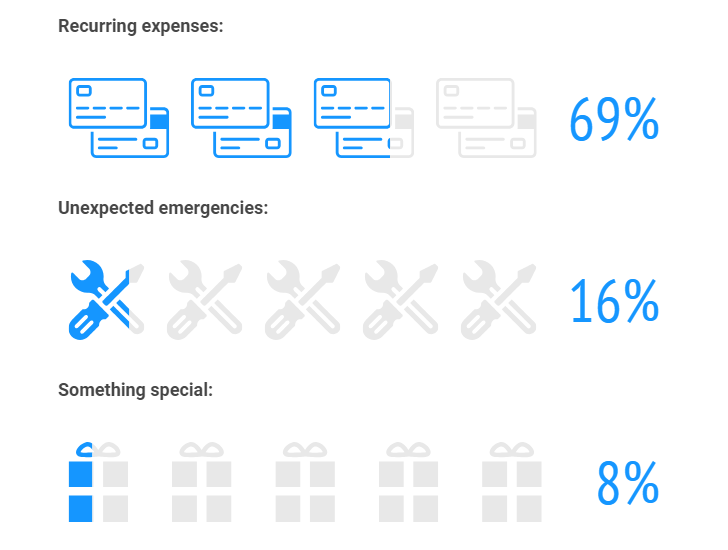

Few reports stated that 33% of payday loans are not borrowed because of a financial pinch and has found to be a growing habit of payday loan borrowing. Mainstream banking, credit cards and mortgage companies are excluded from providing this type of service because of the perceived risk involved. Loan purpose of payday loan market. [Referred to Appendix 2]

Appendix 2: Different purpose of Payday loans

(Source: https://www.finder.com/payday-loans-statistics)

Bouncing Checks and bank overdraft can be considered as payday loans alternatives (Banks et al. 2015). Taking out a Payday loan is a cheaper option than bouncing a check and overdrafts can charge more than it costs to take out a payday loan for the same period, which could be considered as a significant reason for availing payday loans.

An illustration can be considered to understand payday loan practice. A person is willing to avail a payday loan of $300, and fee is determined $50 on that capital. The borrower needs to make a check amounting $350 on a post-dated basis. The liquidation check date needs to be within zero to 14 days (Eisenberg-Guyot et al. 2018).

The lender needs to check the bank statement and employment history of the borrower. Credit check informal way is not a necessary criterion for this type of lending. The borrower if failing to repay on the next payday or the check amount did not clear on the payday may be given the option to renew or extend the existing payday loan by adding $50 more in interest. This kind of borrower is considered as a rollover and as repeat customers.

Banks and different financial institutions abide by strict financial law. These institutions’ loan practice is significantly strict. Loans are not provided on short term cash crisis basis. The reason the main stream financial institutions are not prepared to provide short term and small loans is because of the huge perceived risk of defaults that could be associated with it.

Some checks bounce and late fees are some of the constraints of short term and small amount loan. Payday loan is easier and cheaper option than bank’s loan options if you need a small amount quickly and it is widely known that not everyone who takes out a payday loan has bad credit or is a risk, so when considering this scenario, payday loan practices can be considered a HERO.

Negative aspects

Some payday lenders allow the Payday loan chain lending practice which is when you default on the payment date, but instead of giving you a couple of days to clear the debt, they may just extend the debt for another month and not give you the option to pay earlier. This involves a series of multiple loan renewals when a borrower post-dated check bounces and makes loan payment defaults. The person with an actual financial crisis can pay 400% interest. This lending practice is wrong.

According to different research payday loan demand usually, come from inconsistent saving and consumption of people. Self-control mechanism can be induced to reduce payday loan practices. A ban on payday lending practices can increase self-control in consumption and more savings. Severe regular purchasing habits can lead people towards taking out payday loans. Taking this scenario under consideration, payday lending habit can be determined as a VILLAIN.

Investments need to be more than consumption, and then only payday loan habit can be minimized. Cash flow on an everyday basis, need to control for increase in future savings. According to experts payday loan needs to be banned thoroughly to encourage welfare for long term.

Payday lenders can be treated as both villains and heroes (Howell, 2016). Payday borrowers can be categorized into two different types. The first groups are with real financial needs, and the later are borrowing on a general basis. The latter group encourages the harmful practice of payday lending structure. The group with actual financial needs encourages the welfare side of payday loan structure.

CMA’s finding on payday loan (UK)

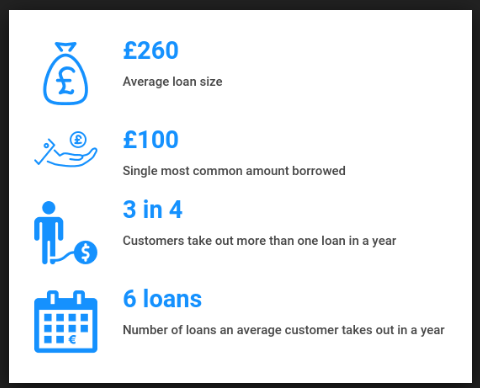

Payday loans of fifteen million were taken between 2012 and 2013 according to CMA. This data was collected on a survey held on fifteen hundred customers and CRA record of 3000 customers of payday loan. The survey report stated 1.8 million loans (payday) in the UK, in 2012. The loan amount was 10.8 billion. The loan amount was increased by 50% from 35% in the financial year. This loan amount was stated based on market size (Barth et al. 2015). 2013 report stated the maximum growth in 2013.

Nine major payday lenders were offering loan in the UK till 2013. They notable names as for are stated as Dollar, Wonga and Cash Euro Net. These organisations were providing loans on a guaranteed revenue basis. The guaranteed loan amount was 70%. Most of the customers were taking loans from an online portal, the volume of the borrowers was 83%. 29% per cent of customers were taken on a traditional practice basis.

Medium income group customers were higher than the high-income group. Most of the customers (2/3rd) paid their agreed amount before the active date in the UK. 80% customers took further loans after their first loan in the same year. The lender might have been the not same, but they were taking out more loans in the same year. Four customers out of ten were taking continue their further borrowing from 2 different payday lenders.

According to the credit rating,

- 38% of customers were facing irresponsible lending experiences.

- 38% of borrowers arranged arrears pay off with their respective creditors.

- 11% passed through a judgment of the country court (Greenwood et al. 2016).

- Debt collectors visited 10% of borrowers.

- Borrowers (52%) were facing a different kind of debt issues or problems in the last 5 years (files.consumerfinance.gov, 2019). [Referred to Appendix 3]

Appendix 3: Payday loan practice in the UK

Source: https://www.finder.com

Customers kept their focus on the availability and speed of the payday loans rather than cost. Customers didn’t compare payday lenders on their loan amount before taking the payday loans. That is why lenders got such a high margin on the loan amount. This practice made the late payment of charges by borrowers (Islam and Simpson, 2018). One customer out of five repaid their loans late. That was an intricate part to collect loans from borrowers and increase the profit for the lenders

The borrowers hardly visited different websites to compare the fees associated with payday loans before taking the loan amount. Those websites were limited with information and scopes to get payday loans. That is why they did not get enough details regarding payday loans before taking them out.

The customers did not even compare other related short term financial instruments with payday loans. The survey stated 6% of customers were unable to get payday loans as the websites were limited with information (personalmoneystore.com, 2019).

Lead generator firms act as mediators to collect loan applicant and distribute to the lenders. These firms acted as media between borrowers and lenders. Nine million leads were generated by top lead generators in the year 2013. Multiple and different websites were used by these lead generator companies. According to the statistic, 130 or more than that were selling the leads related to a payday loan to lenders. The whole payday lender websites were reported as 280.

Twenty-five lead generators were involved in analyzing the leads in 2013. According to this survey report, the payday loan amount was forty-three million in 2013. The payday loan borrowers were frequently suffering from the low transparency of the lead generator websites. This method was quite similar to an auction. The payday leads were sold on an individual basis at upto seventy pounds in the year 2013. The leads were sold on the highest bids. This provided them with an opportunity finding loans by charging from 45 pounds to 70 pounds (brandongaille.com, 2019).

Payday loan statistic in America

Payday loans of $9 billion were reported in the US. According to CNBC, 11% of borrowers took payday loans in the last 2 years. Payday loans gave quick cash option; 400% is recorded rate as an average national annual percentage. 16.5% was the recorded credit card usage. Assuming that the loan amount is $500 with 391% APR, the borrowed amount would be $575 just after one week (Skiba and Xiao, 2017). This cycle seldom finished at that point. That went on an ongoing process. Three months after the borrowing the loan amount would be at $1000 if the terms and conditions remained the same. Based on the standard model working, anyone can easily trap in payday loan practices.

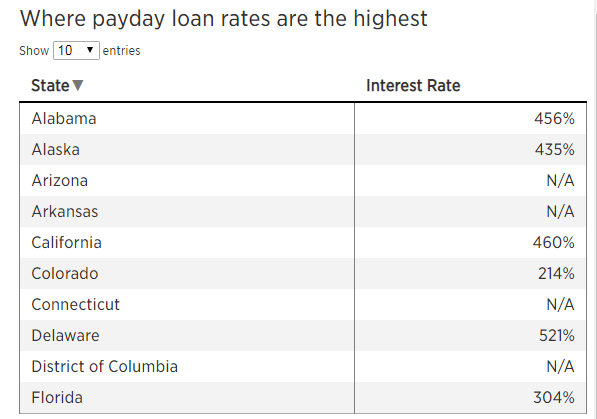

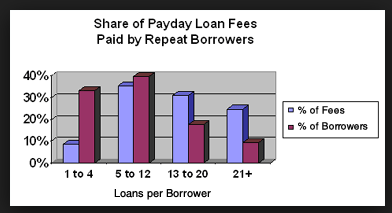

The lender can enjoy a taste of profitability only when the borrowers (payday loan) renewed the loan at least four to eight times. 15 states of Colombia are less affected by payday loans as they have strict laws in accordance. Other thirty-five states were reported with high payday loan volume. Governor of Ohio signed a proposal that stated the payday loan amount up to 60% (Smith and Lane, 2018). Ohio is carrying the highest rate of a payday loan. The rate is stated as 667%. Texas, Nevada, Virginia, Utah and Idaho are the states with a high payday interest rate in the US. The lenders sometimes directly accessed the account of borrowers (Wood et al. 2016) account and unexpectedly withdraw the repayment amount, if the borrowers didn’t have the money available then it not only incurred additional feed but damaged borrower’s credit scores. Low saving during the loan repayment period could be another principal problem for the payday loan borrowers. [Referred to Appendix 4, 5]

Appendix 4: Places with the highest payday loan rates

(Sources: https://www.cnbc.com)

Appendix 5: Repayment by repeat payday borrower in the UK

Source: https://www.responsiblelending.org

Statistics of payday loan practices stated that taking out a payday loan is an easy cash option if you have an urgent need to do so, this provides support for you when there is nowhere else to turn. For those people who needed this type of quick service, a Payday loan was invaluable.

We know that there are some lending clauses that can cause you to payback a lot more than you bargained for, if you get into difficulties but on the whole a payday loan can be considered good if used properly.

Do not use Payday loans or any type of high cost interest lending on a regular basis as you will get further into financial difficulties, speak with your loan company about any payment options if you are experiencing difficulties as they are much more accommodating now than they were a few years ago.

Reference list

Journals

Banks, M., Marston, G., Russell, R. and Karger, H., 2015. ‘In a perfect world, it would be great if they did not exist’: How A Australians experience payday loans. International Journal of Social Welfare, 24(1), pp.37-47.

Barth, J.R., Hilliard, J. and Jahera, J.S., 2015. Banks and payday lenders: friends or foes?. International Advances in Economic Research, 21(2), pp.139-153.

Bhutta, N., Skiba, P.M. and Tobacman, J., 2015. Payday loan choices and consequences. Journal of Money, Credit and Banking, 47(2-3), pp.223-260.

Carter, S.P., 2015. Payday loan and pawnshop usage: the impact of allowing payday loan rollovers. Journal of Consumer Affairs, 49(2), pp.436-456.

Eisenberg-Guyot, J., Firth, C., Klawitter, M. and Hajat, A., 2018. From payday loans to pawnshops: Fringe banking, the unbanked, and health. Health Affairs, 37(3), pp.429-437.

Greenwood, M.M., Sorenson, M.E. and Warner, B.R., 2016. Ferguson on Facebook: Political persuasion in a new era of media effects. Computers in Human Behavior, 57(2), pp.1-10.

Howell, N.J., 2016. Small amount credit contracts and payday loans: The complementarity of price regulation and responsible lending regulation. Alternative Law Journal, 41(3), pp.174-178.

Islam, K.J. and Simpson, W., 2018. Payday Lending and Microcredit: Two Faces of the Same Problem?. Journal of International Development, 30(4), pp.584-614.

Skiba, P.M. and Xiao, J., 2017. Consumer Litigation Funding: Just Another Form of Payday Lending. Law & Contemp. Probs., 80(12), pp.117-120.

Smith, G.P. and Lane, W.P., 2018. Re-Evaluating the Demise of the Average, Ordinary, Reasonable Person: Unintended Consequences in the Law of Nuisance. Catholic University Law Review, 67(4), pp.699-736.

Wood, S., Hanoch, Y. and Woods, G.W., 2016. Cognitive factors to financial crime victimization. In Financial crimes: Psychological, technological, and ethical issues 58(2), pp.129-139.

Websites

assets.publishing.service.gov.uk (2019), about payday loan statistics for ten years, available at: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/362003/Payday_lending___further_statistics.pdf [Accessed on: 25/12/2018]

brandongaille.com (2019), payday loan statistics and analysis for ten years, available at: https://brandongaille.com/21-payday-loan-industry-statistics-trends-analysis/ [Accessed on: 25/12/2018]

files.consumerfinance.gov (2019), payday loan statistics, https://files.consumerfinance.gov/f/201403_cfpb_report_payday-lending.pdf [Accessed on: 25/12/2018]

personalmoneystore.com (2019), payday loan statistics, available at: https://personalmoneystore.com/payday-lending-statistics/ [Accessed on: 25/12/2018]

Appendices

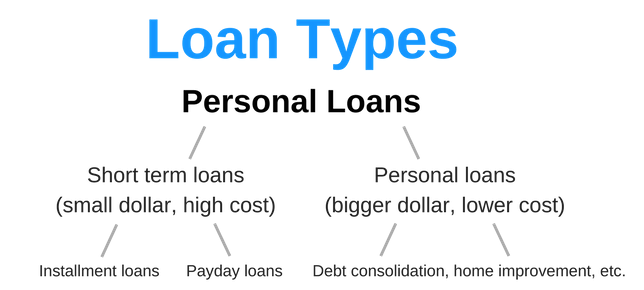

Appendix 1: Types of loans

(Source: https://www.finder.com/payday-loans-statistics)