State Payday Loans

If you find yourself needing to borrow money to cover bills or an emergency expense, state payday loans may be able to provide you with the quick cash you need. These short term loans typically range from $50 to $1,000, depending on where you live.

Click on your state below to find out about their state payday loans.

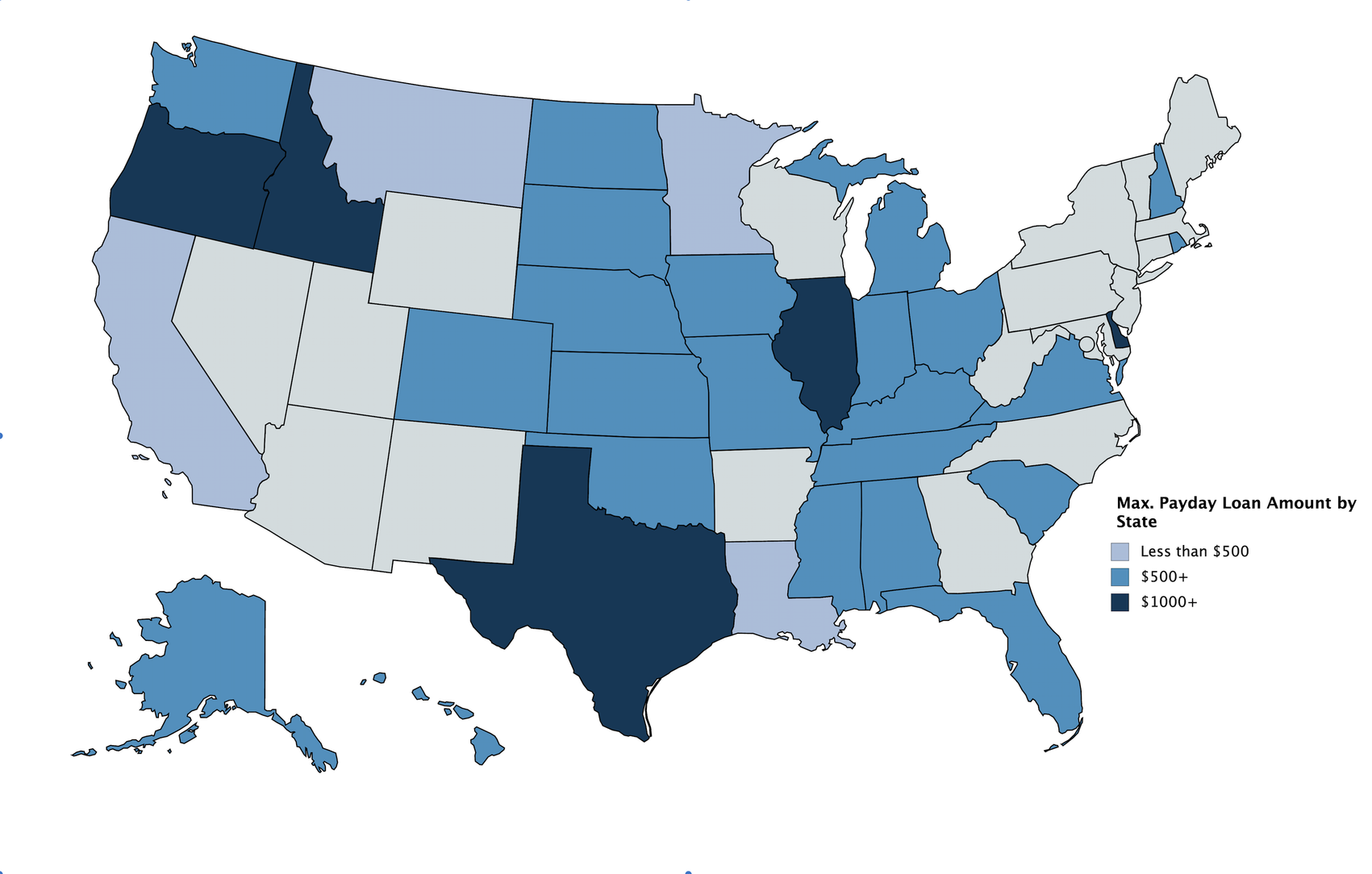

Maximum Payday Loan Amount by State

Note: payday lending is legal in 28 states, with 10 other states allowing some form of short term storefront lending with restrictions. The remaining 12 and the District of Columbia forbid the practice.

While all lenders and LoanPigUSA follow federal regulations, individual states also have laws for lending within their borders. These include regulations dealing with strict adherence to limits on interest rates, rollovers and fees, maximum loan terms, cool-off periods between loans, presentment and more.

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennesse

Texas

Utah

Vermont

Virginia

Washington

Washington DC

West Virginia

Wisconsin

Wyoming

Lending States: Full List

Don't see your state listed? Check out our full list of lending states here.

If you don't have access to a payday loan in your state, you can still find other options to help with financial emergencies. Or if you find yourself in long-term debt problems, consider seeking help in the process of creating a budget and getting out of debt.